The Rise of Sri Lankan DTC and the Payment Challenge

Sri Lanka’s commercial landscape is experiencing a vibrant transformation, fueled by a new generation of entrepreneurs. Direct-to-Consumer (DTC) brands, leveraging the power of social media platforms like Instagram and Facebook, are emerging across various sectors, from fashion and artisanal goods to wellness products. This digital-first approach allows businesses to bypass traditional retail gatekeepers, build direct relationships with their customers, and create authentic brand stories that resonate with local audiences. The appeal is clear: lower overheads, greater market agility, and direct control over the customer experience.

However, this rapid growth has exposed a critical friction point: digital payments. While Sri Lankan consumers are increasingly comfortable shopping online, the payment infrastructure has struggled to keep pace with the specific needs of local DTC brands. Many businesses initially turn to international payment gateways, only to face hurdles such as high transaction fees, complex settlement processes, and mandatory currency conversions that erode their thin margins.

Furthermore, a significant portion of the local market remains hesitant to use credit cards online, preferring familiar, trusted methods. This has led to an over-reliance on Cash on Delivery (COD), a logistical nightmare for small businesses. COD introduces risks of order cancellations, high return rates, and delayed cash flow, stifling the potential for sustainable growth. The disconnect between the burgeoning e-commerce scene and the available payment solutions creates a clear and urgent need for accessible, secure, and localized payment options that build consumer trust and empower Sri Lanka’s DTC innovators to thrive.

Why Localized Payments Matter: The Sri Lankan Shopper’s Mindset

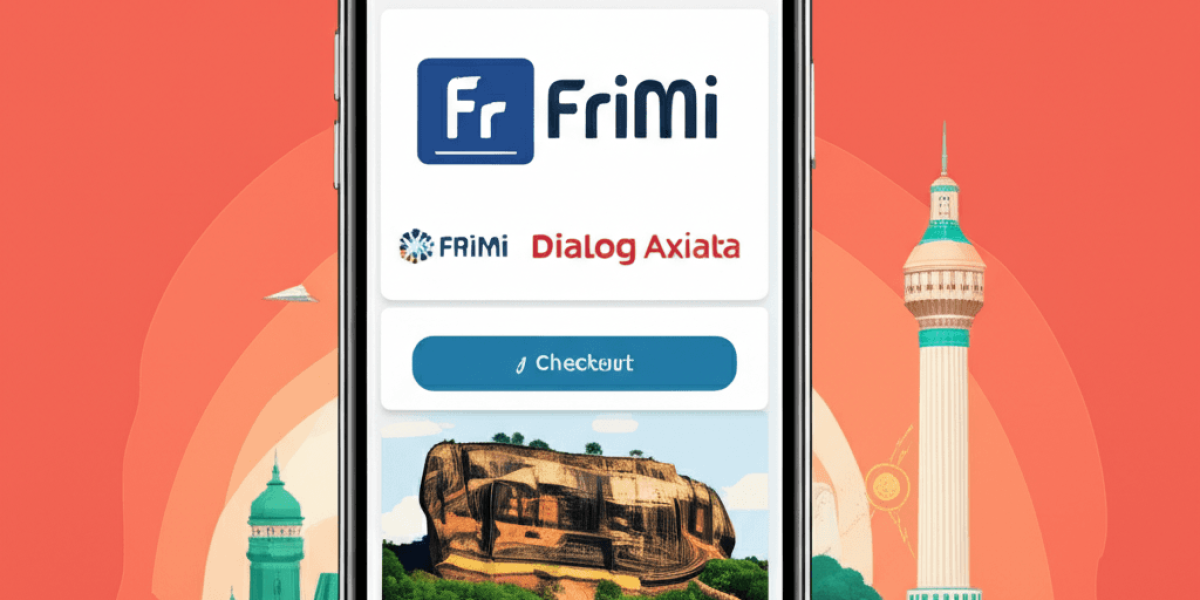

To succeed in Sri Lanka’s burgeoning DTC market, brands must look beyond the product and understand the deep-seated preferences of the local consumer. The checkout page is where trust is either solidified or shattered, and for the Sri Lankan shopper, familiarity is paramount. Seeing a recognizable logo like FriMi or Dialog Axiata isn’t just an option; it’s a signal of security, legitimacy, and local understanding.

The modern Sri Lankan consumer is overwhelmingly mobile-first. They browse, compare, and purchase on their smartphones, and they expect a payment process that mirrors this seamless, on-the-go experience. Traditional credit card forms can feel cumbersome and intimidating, creating unnecessary friction. In contrast, a mobile wallet payment or a direct carrier billing option is intuitive and fast. It aligns with their daily digital habits, where transactions are completed with a simple PIN or a one-time password (OTP).

Furthermore, accessibility is key. Credit card penetration is not universal, but mobile phone ownership is. By offering solutions from FriMi and Dialog Axiata, brands tap into a much wider, more inclusive customer base. These payment methods remove barriers, making online shopping accessible to individuals who may not have traditional banking facilities. It’s a powerful statement that a brand is truly for the Sri Lankan market, not just in it.

Ultimately, it comes down to psychological comfort. Paying through a trusted local provider in Sri Lankan Rupees eliminates worries about hidden conversion fees or foreign transaction complexities. It transforms the final step of a purchase from a moment of hesitation into a simple, confident click. For DTC brands, integrating these localized payments is not a technical upgrade; it’s a fundamental move to connect with the Sri Lankan shopper’s mindset.

Spotlight on FriMi: The Digital Banking Advantage

FriMi, Sri Lanka’s pioneering digital bank powered by Nations Trust Bank, stands at the forefront of the local payment revolution. By leveraging the extensive mobile network of Dialog Axiata, FriMi offers a powerful and localized solution perfectly tailored for the nation’s burgeoning Direct-to-Consumer (DTC) brands. It directly addresses the critical need for a payment method that is simple, trusted, and accessible to a wide audience.

For today’s Sri Lankan consumer, convenience is paramount. Traditional payment gateways that require lengthy card details often lead to friction and abandoned carts. FriMi elegantly solves this by transforming the smartphone into a digital wallet. The integration allows customers to complete purchases with just their mobile number or by scanning a dynamic LANKAQR code at checkout. This seamless, one-tap experience aligns perfectly with the expectations of a mobile-first generation.

The advantage for DTC brands is twofold. Firstly, it unlocks access to a massive, digitally-savvy user base that already trusts the FriMi and Dialog ecosystems. This translates to higher conversion rates and a significant reduction in checkout friction. Secondly, it provides a secure and cost-effective alternative to international payment processors, ensuring that transactions are smooth and efficient.

Ultimately, FriMi is more than just a payment option; it is a strategic tool for growth. By offering a familiar, fast, and secure payment method, Sri Lankan DTC brands can enhance customer loyalty, build trust, and create a frictionless purchasing journey that keeps shoppers coming back.

Spotlight on Dialog Axiata: Reaching the Masses with Telco Power

Dialog Axiata is more than just Sri Lanka’s leading telecommunications provider; it is a foundational pillar of the nation’s digital economy. With a subscriber base that blankets the island, Dialog offers Direct-to-Consumer (DTC) brands an unparalleled channel to connect with millions of potential customers. This extensive reach is the company’s core strength, transforming a simple mobile number into a powerful gateway for commerce and customer engagement.

The key to unlocking this vast market lies in leveraging Dialog’s integrated payment infrastructure, most notably through Direct Carrier Billing (DCB). This powerful mechanism allows consumers to make purchases by seamlessly charging the amount to their prepaid or postpaid mobile bill. For DTC brands selling digital goods, subscriptions, or low-cost physical items, DCB eliminates critical friction at the checkout. It bypasses the need for credit cards or complex bank transfers, catering directly to a mobile-first population that values convenience above all else.

Beyond DCB, Dialog’s robust network provides the essential connectivity and trusted infrastructure that enables digital banking platforms like FriMi to thrive. This synergistic relationship creates a powerful ecosystem for local commerce. A customer’s trusted Dialog connection becomes the reliable pipeline to access their digital wallet, ensuring a fluid and secure payment experience from product discovery to final purchase.

For Sri Lankan DTC brands, this translates into a strategic advantage. Partnering with Dialog is not just about adopting a new payment method; it’s about gaining access, building trust, and achieving mass-market penetration. By harnessing the power of the nation’s largest telco, brands can effectively overcome traditional financial barriers and meet the modern Sri Lankan consumer right where they are: on their mobile phone.

Practical Steps: Integrating Local Payments into Your E-commerce Store

Adding FriMi and Dialog Axiata payment options to your direct-to-consumer (DTC) store is a strategic move to meet local demand. The process is manageable and can be broken down into a few key steps to ensure a seamless transition for you and your customers.

-

Evaluate Your E-commerce Platform

Your integration path depends on your store’s foundation. If you use a popular platform like Shopify or WooCommerce, you can often leverage pre-built plugins or apps. For custom-built websites, you will need to work with your developer on a direct API integration.

-

Partner with a Local Payment Gateway

Instead of integrating with FriMi and Dialog Axiata individually, partner with a Sri Lankan payment gateway. These gateways act as aggregators, offering multiple local payment methods—including FriMi, Dialog eZ Cash, and Genie—through a single integration. Research gateways that explicitly support these services and offer competitive transaction rates.

-

Install and Configure the Gateway

For platforms like WooCommerce, this involves installing the gateway’s official plugin and entering your merchant credentials. For Shopify, you’ll activate the provider from the list of supported payment gateways. For custom sites, your developer will use the gateway’s documentation to connect its API to your checkout process.

-

Test Thoroughly in a Sandbox Environment

Before going live, use the gateway’s sandbox or test mode. Process several mock transactions using the FriMi and Dialog options to ensure the payment flow is smooth, order statuses update correctly, and customers receive proper confirmation. This step is critical to prevent lost sales and customer frustration.

-

Launch and Promote Your New Options

Once testing is complete, switch the gateway to live mode. Update your website’s footer and checkout page with the logos of FriMi and Dialog Axiata to build trust. Announce the new, convenient payment methods to your audience through social media and email newsletters to encourage adoption.

Conclusion: Gain a Competitive Edge with Localized Payments

The Sri Lankan e-commerce landscape is evolving rapidly, and for Direct-to-Consumer (DTC) brands, success is no longer just about offering a superior product. It is about delivering a seamless, trustworthy, and intuitive end-to-end customer experience. The payment process, once a simple final step, has now become a critical battleground for customer acquisition and retention. Overlooking the specific payment preferences of the local market is a missed opportunity that competitors will readily exploit.

Integrating mobile-first, trusted payment solutions like FriMi and Dialog Axiata’s payment platforms is not merely a technical upgrade; it is a strategic business decision. These platforms represent how a significant and growing segment of Sri Lankan consumers manage their finances. By offering these options, brands directly address emerging client needs for convenience, security, and accessibility, significantly reducing checkout friction and cart abandonment.

By embracing localized payments, Sri Lankan DTC brands can unlock several key advantages:

- Increased Conversion Rates: Simplify the checkout process and cater to preferred payment habits, turning more visitors into paying customers.

- Enhanced Customer Trust: Offer familiar and widely used payment gateways, building confidence and fostering loyalty with your brand.

- Broader Market Reach: Tap into a wider demographic, including the unbanked and mobile-native youth who rely on digital wallets over traditional credit cards.

- Future-Proofing Your Business: Align your brand with the nation’s digital transformation, positioning it as a modern and customer-centric enterprise.

In conclusion, the path to sustainable growth for DTC brands in Sri Lanka lies in deeply understanding and adapting to local consumer behavior. Adopting FriMi and Dialog Axiata’s payment solutions is a powerful, decisive step towards meeting your customers where they are, ultimately creating a competitive edge that is difficult to replicate.