The AI Revolution in Rural Microfinance

For years, small business owners in rural Sri Lanka faced major hurdles in getting loans. Traditional banks required extensive credit histories and paperwork that many entrepreneurs, such as farmers or local artisans, simply did not have. This lack of access to capital, known as financial exclusion, made it difficult for them to buy new equipment, expand their operations, or even manage daily cash flow. The cost for banks to serve remote customers was also high, leaving many communities underserved.

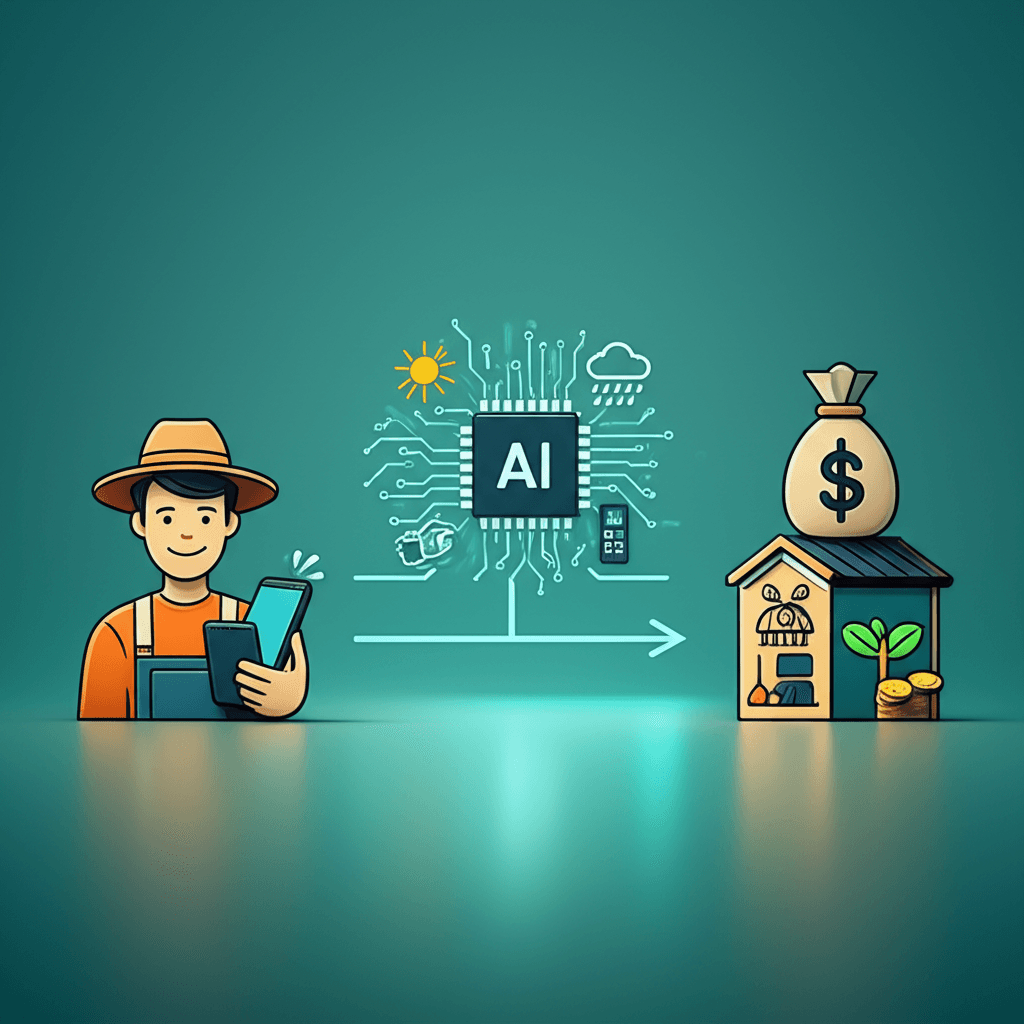

Today, Artificial Intelligence (AI) is transforming this landscape. AI-powered microfinance platforms are using new methods to assess creditworthiness. Instead of relying only on past bank loans, these systems analyze alternative data, such as mobile phone top-up patterns or utility bill payments. This gives a more complete and fair picture of an applicant’s ability to repay a loan. The entire process, from application to approval, is automated, making it faster, cheaper, and more accessible for everyone.

This technological shift provides a vital lifeline to rural small and medium-sized enterprises (SMEs). A farmer can get a quick loan to buy seeds before planting season, or a shop owner can secure funds to increase inventory for a local festival. By unlocking access to credit, AI development in Sri Lanka is directly boosting local economies and empowering entrepreneurs. However, this progress also highlights a growing divide. While AI provides the financial tools for growth, it doesn’t automatically provide the digital and business management skills needed to use that capital effectively in an increasingly digital marketplace.

Fueling Growth: The Positive Impact on Rural Economies

For decades, small and medium-sized enterprises (SMEs) in rural Sri Lanka have faced a major hurdle: access to money. Traditional banks often see them as too risky. However, AI-powered microloans are changing this story. By using new ways to check creditworthiness, these financial tools offer a lifeline to farmers, artisans, and small shop owners who were previously left out.

This new access to capital has a direct and powerful effect. A small loan can help a farmer buy better seeds or equipment, leading to a bigger harvest. It can allow a craft maker to purchase raw materials in bulk, lowering costs and increasing profits. As these small businesses grow, they often hire people from their own community. This creates jobs and keeps money circulating within the local economy, helping everyone prosper.

More than just cash, these loans encourage rural businesses to join the digital world. With funding secured, an entrepreneur can invest in building a simple e-commerce website. They can begin to accept localized digital payments, making it easier for customers to buy from them. This small step opens their products to a much wider market beyond their village. For ambitious businesses, it’s the first move toward bigger goals, like expanding into cross-border trade in the future. By empowering entrepreneurs at the grassroots level, AI microloans are planting the seeds for stronger, more resilient rural communities.

The Unintended Consequence: A Widening Skill Divide

While AI-powered microloans are a great success for rural Sri Lanka, they come with a hidden cost. This new flow of money helps small businesses grow. A farmer can buy better tools, and a local shop can add more products. This creates much-needed jobs in villages, boosting local economies and providing stable incomes for many families.

However, the new jobs are often in traditional fields like farming, crafts, or small-scale retail. These roles are vital for the community but do not always build the high-tech skills needed for the future. The focus is on expanding current operations, not necessarily on digital transformation.

At the same time, Sri Lanka’s cities are moving in a different direction. Urban areas are becoming centers for technology and innovation. Companies are hiring people with advanced skills in software development, data analysis, and digital marketing. These are the jobs that pay higher salaries and have more room for growth. This trend shows AI’s double edge, where technology creates high-skill roles in one area while leaving others behind.

This creates a growing skill divide. Rural areas gain stability through traditional work, while cities capture the high-value jobs of the digital age. Without a plan to bring digital training and modern business skills to rural areas, we risk creating two very different economies within the same country. The challenge now is to ensure that the benefits of technology lift everyone up, not just those in urban centers.

Bridging the Chasm: Solutions for Equitable Growth

AI-powered microloans give rural businesses a vital financial boost. However, money alone cannot solve the widening skill gap between urban and rural areas. To create fair and lasting growth, we must pair this financial access with targeted education and digital training. This approach ensures that new entrepreneurs have the tools they need to not only start a business but also to make it thrive in the modern economy.

The solution lies in creating practical learning programs for rural small and medium-sized enterprises (SMEs). These programs should focus on essential digital skills. Entrepreneurs need to learn what it really takes to create a successful website for your business. Training should also cover the basics of online marketing, managing digital payments, and providing excellent customer service online. By building these skills, rural businesses can compete on a level playing field with their urban counterparts.

Furthermore, this education must be forward-looking. Teaching rural entrepreneurs about the top WordPress e-commerce trends can empower them to build powerful online stores that reach customers across Sri Lanka and even internationally. This can be achieved through partnerships between government agencies, financial institutions, and tech education providers. Mobile training units and online workshops in local languages can make this learning accessible to everyone.

By combining financial support with digital skill development, we can close the opportunity gap. This strategy turns a simple loan into a long-term investment in people and their communities. It helps build a stronger, more inclusive economy where success is not limited by location.

References

- Financial Inclusion Overview – The World Bank

- How artificial intelligence can deepen financial inclusion – The Brookings Institution

- How to bridge the rural-urban skills gap – World Economic Forum

- What Is A Microloan? – Forbes Advisor